does wyoming charge sales tax

This page discusses various sales tax exemptions in Wyoming. Since books are taxable in the state of Wyoming Mary charges her customers a flat-rate sales tax of 600 on all sales.

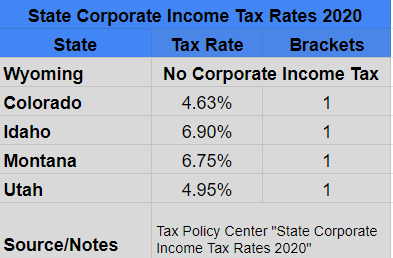

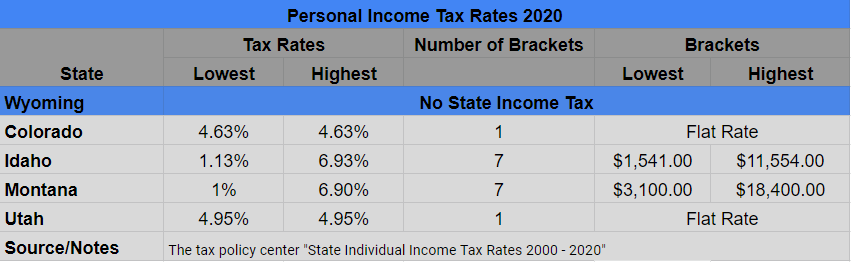

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

But as budget cuts wont solve the crisis the state may need to consider tax increases.

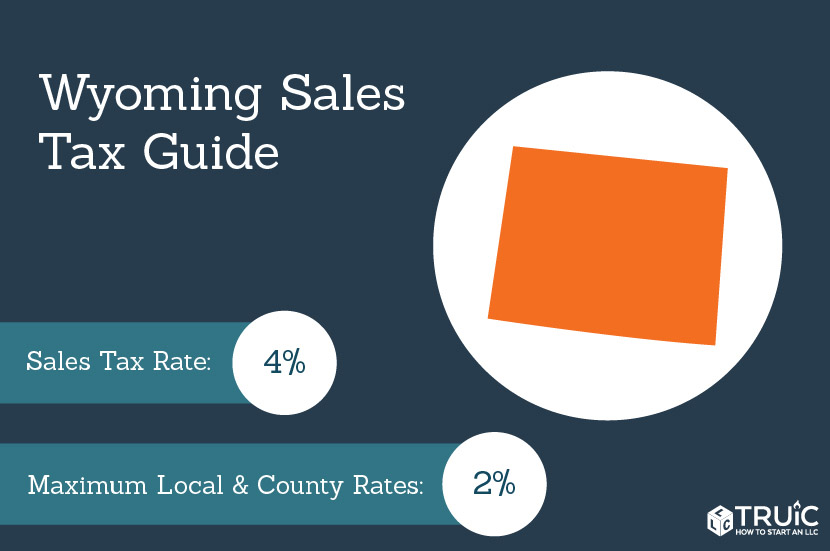

. Services are subject to sales tax in a number of states. Heres an example of what this scenario looks like. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area.

Owners pay federal income tax on any profits minus federal allowances or deductions. Pennsylvania for example charges tax on numerous services including but not limited to lobbying services secretarial or editing services and building maintenance or cleaning services. There are several exemptions to the state sales.

There are additional levels of sales tax at local jurisdictions too. View our complete guide to Wyoming sales tax with information about Wyoming sales tax rates registration filing and deadlines. And then theres California.

Instead taxes are as follows. This includes Wyomings sales tax rate of 400 and Laramie Countys sales tax rate of 200. Currently combined sales tax rates in Wyoming range from 4 to 6 depending.

The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. Should You Charge Sales Tax on Digital Products. In Cheyenne for example the county tax rate is 1 for Laramie County resulting in a total tax rate of 5.

Charge the tax rate of the buyers address as thats the destination of your product or service. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1472 for a total of 5472 when combined with the state sales tax. Select the Wyoming city from the list of popular cities below to see its current sales tax rate.

The state of Wyoming does not usually collect. Mary owns and manages a bookstore in Cheyenne Wyoming. Owners pay self-employment tax on business profits.

If I buy cigars from a company in Colorado who is not a wholesaler in Wyoming as a Wyoming vendor am I responsible for the 20 excise tax. Wyoming has recent rate changes Thu Apr 01 2021. With local taxes the total sales tax rate is between 4000 and 6000.

According to House Bill 169 raising the state sales and use tax rate from 4 to 5 could generate between 138 and 142 million for the state annually and approximately 63 million for localities. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. Wyoming has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state.

Wyoming is the cheapest state to buy a beer in the state excise tax on beer is only 002 per gallon. Employers pay payroll tax on any salaries they pay to. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation.

You can look up the local sales tax rate with TaxJars Sales Tax Calculator. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. See the publications section for more information.

Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. While North Carolinas sales tax does apply to movie tickets among other items it excludes the purchase of lottery tickets. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

Sales Tax Exemptions in Wyoming. Learn about standard filing costs here. This is the same whether you live in Wyoming or not.

The Wyoming Department of Revenue has issued a news bulletin regarding the taxability of professional services. Which means that the rate you will charge your customers is determined by where they actually take possession of the product or where they. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

This page describes the taxability of services in Wyoming including janitorial services and transportation services. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. A third sales tax you might encounter in Wyoming is an optional 6th penny or 6 special.

The maximum local tax rate allowed. Wyomings sales tax is the 44th lowest in the nation and its tax on beer is the 50th unchanged since 1935 when it was set at 002 a gallon. Wyoming Use Tax and You.

State wide sales tax is 4. Tax rate charts are only updated as changes in rates occur. The state of Wyoming has a 4 state sales tax for all purchases of goods and services in Wyoming.

An example of taxed services would be one which sells repairs alters or improves tangible physical property. The state-wide sales tax in Wyoming is 4. The Excise Division is comprised of two functional sections.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. You might still have to charge out-of-state sales tax based on the tax rate of the destination state if youre a remote seller in an origin. In addition many counties assess an optional 5th penny or 5 general purpose tax which is also incurred on goods and services purchased in that county.

In Wyoming when a tool is lost down a hole or damaged beyond repair during the pre-production casing phase of an oil or gas well the charge for the tool will not be subject to sales tax. Does Wyoming charge sales tax on vehicles. The state sales tax rate in Wyoming is 4000.

These fees are separate from the sales tax and will likely be collected by the Wyoming Department of Motor Vehicles and not the Wyoming Department of Revenue. To learn more see a full list of taxable and tax-exempt items in Wyoming. We advise you to check out the Wyoming Department of Revenue Tax Rate for 2020 PDF which has the current rates.

Are services subject to sales tax in Wyoming. It is also the same if you will use Amazon FBA there. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. But the measure wasnt created to fill the hole dug by. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935.

Some LLCs pay Wyoming sales tax on products. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. In addition to taxes car purchases in Wyoming may be subject to other fees like registration title and.

If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. Average DMV fees in Wyoming on a new-car purchase add up to 5721 which includes the title registration and plate fees. The wholesaler shall be entitled to retain four percent 4 of any tax collected under WS.

In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. This means that a carpenter repairing a roof would be required to collect sales tax. This state has a modified origin system in place in which state county and city taxes are origin-based but district transaction taxes are destination-based.

When to charge sales tax on shipping. Groceries and prescription drugs are exempt from the Wyoming sales tax. Sales Use Tax Rate Charts.

The state sales tax rate in Wyoming is 4. Wyoming has 167 special sales tax jurisdictions with local sales taxes in.

Sales Tax For Online Or Remote Vendors A Study In Complexity Wyoming Small Business Development Center Network

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

How To File And Pay Sales Tax In Wyoming Taxvalet

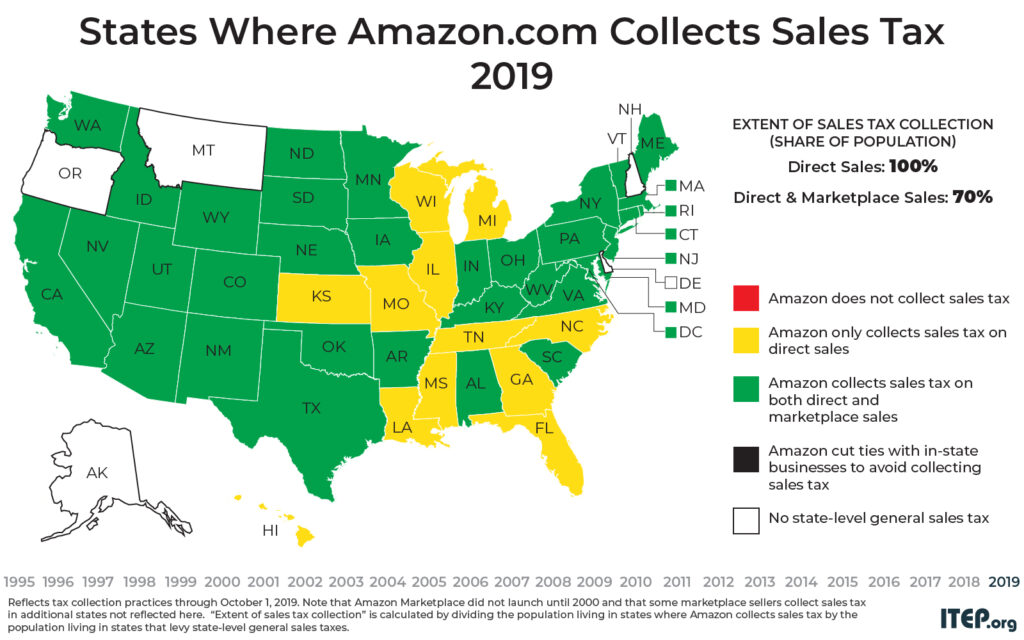

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Business State Tax Obligations 6 Types Of State Taxes

Sales Tax By State Is Saas Taxable Taxjar

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

Wyoming Sales Tax Rates By City County 2022

How To File And Pay Sales Tax In Wyoming Taxvalet

Wyoming Sales Tax Small Business Guide Truic

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

How Do State And Local Sales Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To File And Pay Sales Tax In Wyoming Taxvalet